Did you see the recent news from the ACCC that scammers are using games such as Words with Friends and Scrabble to make contact with their victims and develop relationships for romance scams? I did, and I’ve also had reports of scam contacts being made via Language Learning classes, and via LinkedIn. From my experience, in just about any organisation requiring membership, the member can be vulnerable to scammer contact. They set up a fake profile and/or membership and join in activities of that group, and make what seems to be a friently, if unsolicited contact asking to chat…

The Media Release identifies that romance scammers have moved beyond online dating sites to Facebook and Instagram and now include these popular game sites.

Scammers will still use their old contact mechanisms, but as prevention messages grow in volume, potential victims are more likely to be sceptical and avoid the common pitfalls when they are easily identifiable. Unfortunately, warnings are not yet covering the need to avoid unsolicited contacts on these gaming sites.

Continue reading Scammers are the ultimate opportunists

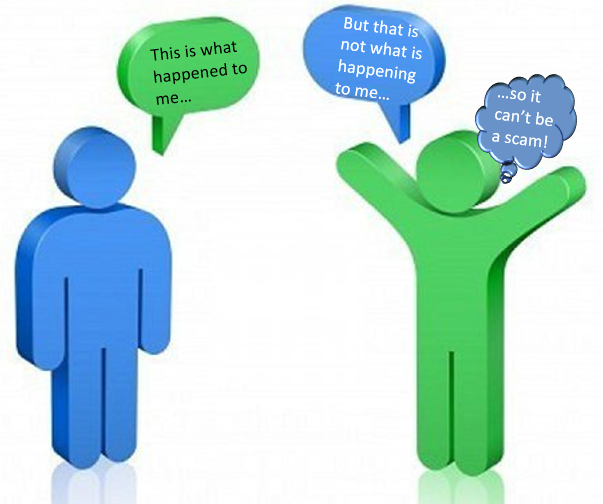

put me in the box of “lonely, therefore scam- able”. I wanted to scream, because I knew he was also making the leap to “I’m not lonely, therefore it won’t happen to me”. They all wanted to believe “it won’t happen to me”. All 90 of them listening to my talk on how I was scammed. It was similar to those other questions which implied that I was gullible or stupid to fall for a scam.

put me in the box of “lonely, therefore scam- able”. I wanted to scream, because I knew he was also making the leap to “I’m not lonely, therefore it won’t happen to me”. They all wanted to believe “it won’t happen to me”. All 90 of them listening to my talk on how I was scammed. It was similar to those other questions which implied that I was gullible or stupid to fall for a scam.

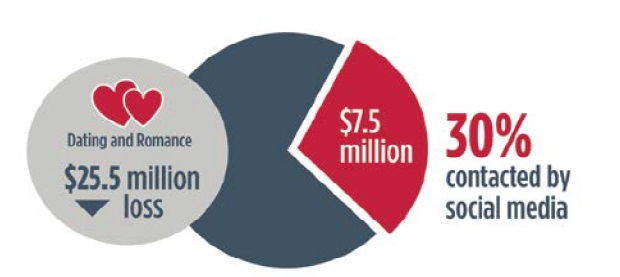

Unfortunately, the figures reported cannot be regarded as a true level. It is generally acknowledged reporting is only at about 10% – 12% of actual cases. I was interviewed by Catherine Gregory of ABC News for

Unfortunately, the figures reported cannot be regarded as a true level. It is generally acknowledged reporting is only at about 10% – 12% of actual cases. I was interviewed by Catherine Gregory of ABC News for

Whilst the cited cases are based around sending money to China for people or drug trafficking, and aiding and abetting offshore gambling, the terms of the overall judgement, taken jointly by a large number of US agencies, are much more general than just this. The problems with Western Union, according to them included:

Whilst the cited cases are based around sending money to China for people or drug trafficking, and aiding and abetting offshore gambling, the terms of the overall judgement, taken jointly by a large number of US agencies, are much more general than just this. The problems with Western Union, according to them included: